PAMM Account Overview

Percentage Allocation Money Management (PAMM) is a solution where a professional account manager executes trades on behalf of clients. In this setup, the account manager acts as the Fund Manager, while the clients are the Investors. The PAMM account allows investors to pool their funds together, providing them with access to professional fund managers and their trading strategies.

How Does PAMM Work?

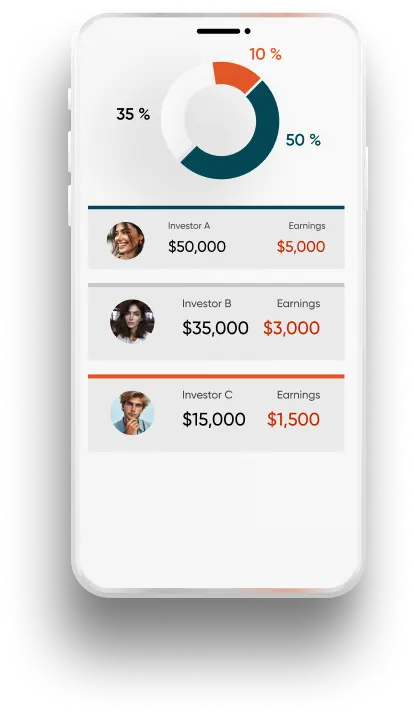

Investors often face capital limitations when trading independently. To overcome this challenge, a PAMM account allows the Fund Manager to pool funds from multiple investors into a single trading strategy. Investors receive a share of the profits proportionate to their contribution to the PAMM account's capital.

For Fund Managers, a PAMM account provides access to significant funds and an opportunity to earn a performance fee. It serves as an effective means for investors to access high-capital trading strategies. Typically, the returns are shared based on the investors' contributed amount as a percentage of the total PAMM account's capital.

Why do You Choose a PAMM

Account?

PAMM accounts provide investors with an opportunity to leverage on the expertise of other investors, and pools funds together for potentially larger returns. Vantage facilitates this by offering unlimited investor admission into each of the funds. Moreover, the Fund Manager retains complete control over all trading decisions, ensuring efficient execution and management of the fund's trading strategy.

9 Reasons to Start Using

Vantage PAMM Account

Join Our

PAMM program

Sign Up

Join one of the leading multi-asset brokers and select any of our flexible programs.

Refer Clients

Refer new clients to Vantage and grow your referral or affiliate business.

Earn More

Earn above-industry level CPA and revenue from every referred account and the trades made.

PAMM Account Blogs

PAMM Account

FAQs

-

1

What is a PAMM account?

Percentage Allocation Money Management (PAMM) accounts, also referred to as Percentage Allocation Management Modules, are investment accounts offered by forex brokers. These accounts allow investors to pool their funds and have them managed by experienced traders and trade on their behalf.

-

2

Are PAMM accounts legit?

Yes, investing in PAMM accounts is a legitimate option for investors. PAMM accounts are offered by forex brokers. It is essential to choose a broker with a solid reputation and proper regulatory oversight to ensure the security and transparency of your investments.

-

3

What are the benefits of PAMM account?

For partners that are managing accounts on behalf of their clients, the PAMM account will allow them to manage all the client´s accounts simultaneously from the same platform and distribute the profits or losses proportionally between the various accounts automatically, instead of having to manage the client´s accounts one by one in case they are not using a PAMM account.

-

4

How do I withdraw money from my PAMM account?

The performance fee will be calculated based on each trading interval (monthly, weekly, etc.). Once a trading interval is completed, the performance fee will be credited to the Fund Manager's Vantage IB wallet. The Fund Manager can then submit a withdrawal request through the Vantage portal to initiate the withdrawal process.

-

5

What is the difference between PAMM and MAM account?

MAM and PAMM accounts differ in terms of fund allocation and management. In a PAMM account, a trader makes investment decisions for a pooled fund, with profits and losses distributed among investors based on their allocated percentages. In a MAM account, a manager trades proportionally across individual accounts, allowing investors to maintain control and customise their risk preferences.

Learn more about the differences between the two accounts here.

Have a Question?

Get in Touch

If you have any questions or enquiries, fill in the form in this section. Alternatively, contact us at [email protected] and one of our Account Managers will get back to you soon.

"*" indicates required fields